Republic Act No. 12001: Real Property Valuation & Assessment Reform Act (RPVARA)

Republic Act No. 12001: Real Property Valuation & Assessment Reform Act (RPVARA)

Republic Act No. 12001: Real Property Valuation & Assessment Reform Act (RPVARA)

For everybody’s information

The Philippine government has passed Republic Act (R.A.) No. 12001, also known as the Real Property Valuation and Assessment Reform Act (RPVARA). This landmark law was enacted in June 2024 and became effective on July 5, 2024.

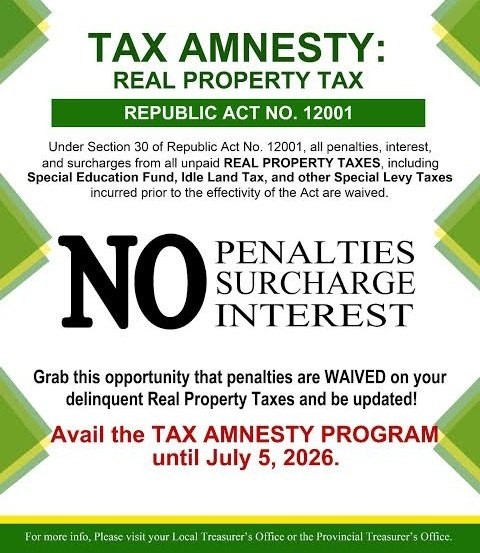

One of the key provisions of this law is the Real Property Tax Amnesty, which offers significant relief to property owners who have unpaid real property taxes.

---

What is the Real Property Tax Amnesty?

What is the Real Property Tax Amnesty?

Waiver of Penalties: All penalties, surcharges, and interest on unpaid Real Property Taxes (RPT) before July 5, 2024 are condoned.

Basic Tax Only: Taxpayers only need to settle the basic RPT amount.

Coverage: This includes not just RPT, but also the Special Education Fund (SEF), Idle Land Tax, and other special assessments.

Duration: July 5, 2024 to July 5, 2026 (2 years to settle)

Duration: July 5, 2024 to July 5, 2026 (2 years to settle)

---

Is It Nationwide?

Is It Nationwide?

Yes. This amnesty applies nationwide and must be implemented by all LGUs.

Yes. This amnesty applies nationwide and must be implemented by all LGUs.

The BLGF (Bureau of Local Government Finance) issued Memorandum Circular No. 003-2025 to guide implementation.

LGUs may pass ordinances for the manner of payment (e.g., full or installment), but the amnesty itself applies whether or not an ordinance is passed.

---

Who is Not Covered?

Who is Not Covered?

This amnesty cannot be availed if:

The property has already been auctioned.

The taxpayer is already under a compromise agreement with payments ongoing.

The case is under litigation in court.

---

How Can Property Owners Avail?

How Can Property Owners Avail?

1. Verify your eligibility – check that delinquent taxes are before July 5, 2024.

2. Prepare documents – Tax Declaration No., title/ownership proof, valid ID.

3. Go to your City/Municipal Treasurer’s Office – request a computation under the RA 12001 amnesty.

4. Choose payment mode – full or installment, as allowed by your LGU.

5. Pay only the basic tax – penalties and surcharges should be automatically waived.

---

Why This Matters

Why This Matters

This law is a big opportunity for property owners to clean up their tax records and avoid future legal or financial complications.

Easier transfer, sale, or mortgage of properties.

Helps LGUs collect much-needed revenue.

Encourages better compliance moving forward.

---

Source References:

Source References:

Republic Act No. 12001, Real Property Valuation and Assessment Reform Act

BLGF Memorandum Circular No. 003-2025

Cebu Provincial Government – Public Information Office

---

Disclaimer

Disclaimer

This blog is for general informational purposes only. It should not be taken as legal or financial advice. For specific guidance on your property tax situation, please consult your City/Municipal Treasurer’s Office or a licensed tax/legal professional.